Menomonee Falls, Wisconsin – After a disappointing third quarter, Kohl’s is adopting a more cautious financial stance for the rest of the year.

“Even though we had a great overall performance in our main growth areas, such as Sephora, home décor, gifting, and impulse, and we also benefited from the opening of Babies “R” Us stores in 200 of our stores, these were not enough to counteract the declines in our core business,” stated CEO Tom Kingsbury, who will leave his position early next year.

Seasonal and daily décor sales increased by over 50% as a result of the company’s expanding pet and home décor assortments. Kohl’s increased sales of impulsive items by 40% after adding lines to 200 more locations.

Sales in the retailer’s legacy home categories, especially floor care, kitchen appliances, and bedding, are still being worked on. For the holidays, Kohl’s is enhancing its value message, expanding its innovation, and launching new brands.

Sales of clothing and shoes were particularly affected by slack business.

“In everything we do, we have to prioritize the customer and execute at a higher level,” Kingsbury stated.

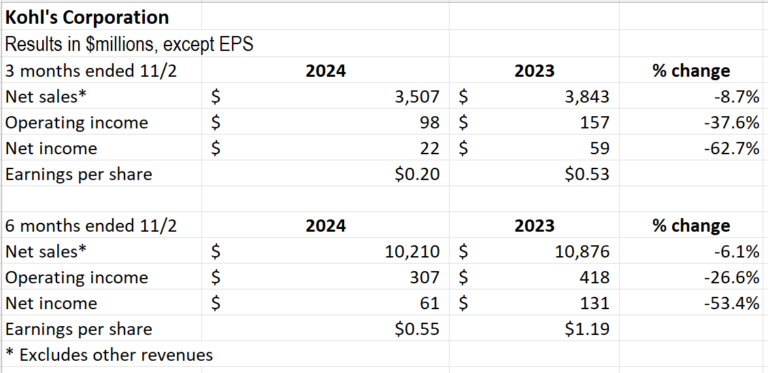

Net sales fell 8.8% to $3.5 billion for the quarter that ended on November 2nd, while comp fell 9.3%. The gross margin increased by 30 basis points year over year to 29.1% of net sales.

Net income fell nearly 63% to $22 million, while operating income fell nearly 38% to $98 million.

This morning, Kohl’s reduced its fiscal year sales and earnings forecast. Instead of predicting a decline in net sales in the range of 4% to 6%, it now anticipates a decline in the range of 7% to 8%. Compared to the initial prediction of a 3% to 5% fall, comps are predicted to be down 6% to 7%.

The business anticipates diluted profits per share to be between $1.20 and $1.50. In the past, it had set EPS between $1.75 and $2.25.