Dublin, California : Ross Stores attributed its poor performance in the third quarter to execution errors.

Sales were also impacted by Hurricanes Helene and Milton as well as unusually warm weather, according to departing CEO Barbara Rentler, who will leave in early February. However, she acknowledged that the team’s progress on merchandising prospects in certain areas was slower than it should have been.

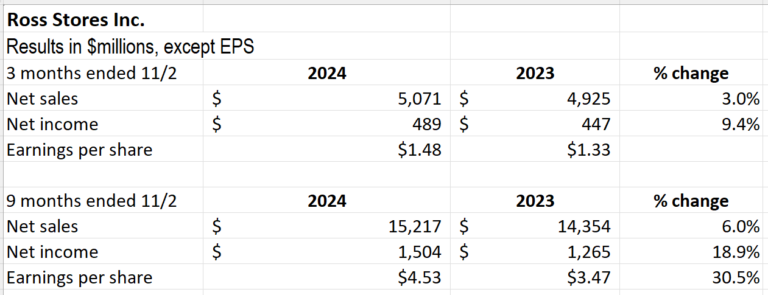

The quarter ended November 2 saw a 3% increase in sales to $5.1 billion, with a 1% comp up. Comp gains at the DD’s Discounts chain were higher than those at Ross Dress for Less outlets, just like in the second quarter.

Throughout the quarter, children’s, accessories, and cosmetics were the best-performing categories. Yesterday evening, on their Q3 call with investors, company leaders made no mention of the home business.

“Earnings exceeded our expectations, even though sales were below plan,” Rentler added. “The anticipated decline in merchandise margin was more than offset by lower incentive, freight, and distribution costs, resulting in an operating margin of 11.9% for the quarter, up from 11.2% last year.”

Compared to 39% last year, packaway products accounted for 38% of total inventory at the end of the quarter.

In the third quarter, the business finished its yearly store opening plan. After a few store closures and relocations in Q4, it anticipates having 1,831 Ross Stores and 354 DD’s locations by the end of the year.

Earnings per share for the 52 weeks ending February 1, 2025, are now anticipated to be between $6.10 and $6.17, up from $5.56 last year, based on year-to-date results and Ross’ fourth quarter prediction. The 53rd week of this year’s retail calendar contributed about $0.20 in earnings per share to the 2023 fourth quarter and full year results.