Ahead of its 44th Foundation Day on August 3, the Bhartiya Udyog Vyapar Mandal (BUVM) held a press conference in the capital today, outlining a comprehensive set of policy demands aimed at improving ease of doing business, simplifying tax structures, and ensuring fair trade practices for MSMEs, local traders, and small businesses across India.

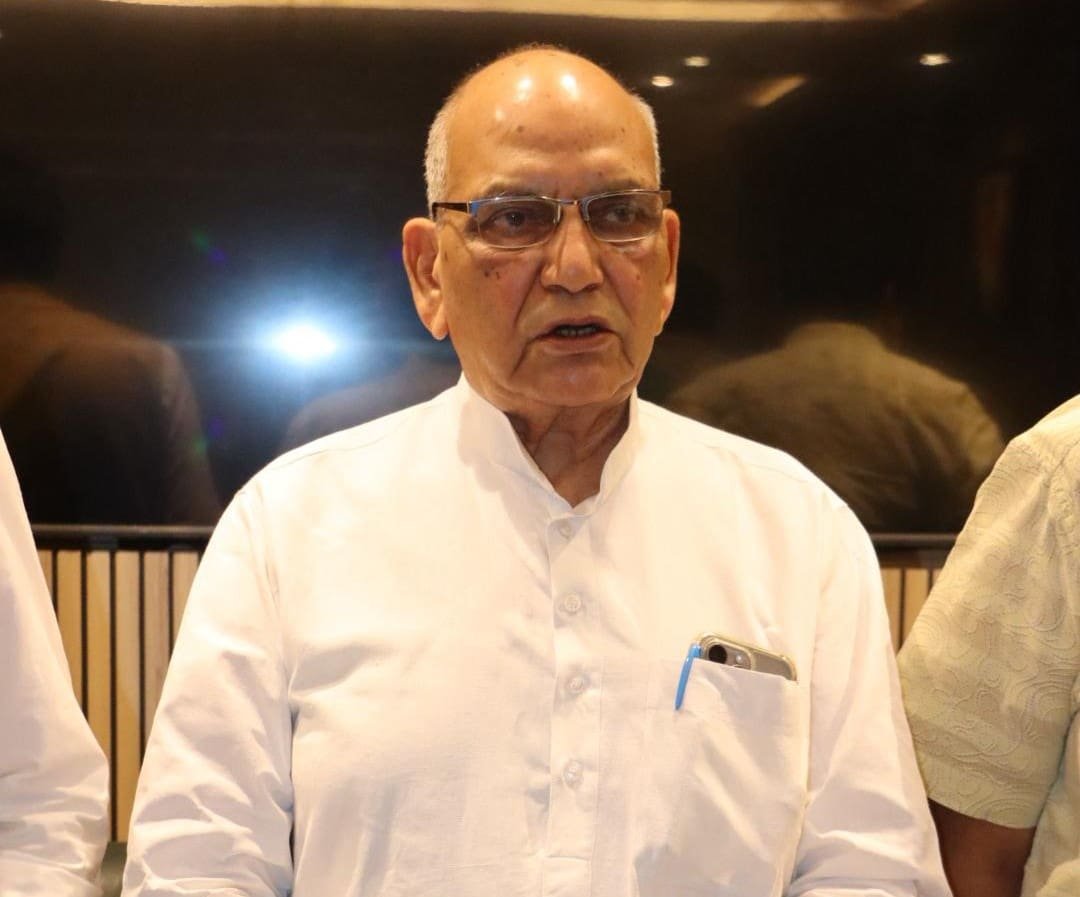

During the event, BUVM President Shri Babu Lal Gupta emphasized the need to rationalise GST tax slabs, citing the current complexity as a key challenge for MSMEs and the trader community.

“The government is focussing on ease of doing business. One of the major pain points has been the multiple GST tax slabs which creates challenges especially for MSMEs and trader community alike. The issue needs to be resolved and we have written to various government authorities suggesting rationalisation of GST rates into three slabs – 0%, 5% and 18%. We believe if accepted, this will pave the way for higher GDP growth,” he stated.

He further proposed that food products—regardless of packaging—be placed under the zero-tax bracket, while products such as cleaning and grading machinery, edible oils, bakery goods, handicrafts, LED lamps, hotel rooms under ₹1000/day, and stainless steel products should fall under the 5% GST slab. All other items should be taxed at 18%, the association proposed.

Call for Uniform Mandi Cess

BUVM also pointed to state-level inconsistencies in Mandi cess, which currently range from 0% to 4%. Shri Mukund Mishra, National Senior General Secretary, BUVM, recommended a uniform Krishi Mandi Cess of 50 paise per ₹100 across the country.

“This will ensure all farmers and traders compete fairly, regardless of location. It also aligns with One Nation, One Market and will help boost the coffers of the State Governments,” he said.

FSSAI Testing Frequency: Small Businesses Strained

Raising concerns over frequent food safety compliance costs, Shri Prem Arora, President, BUVM Delhi, advocated for extending FSSAI’s sample collection timeline from once every six months to once a year.

“This is a very costly exercise in maintaining compliance, causes financial burdens on small businesses, and potential legal repercussions for non-compliance. We demand that this be done once a year,” he emphasized.

Demand for E-Commerce Regulator

Amid growing concerns about unregulated e-commerce practices and predatory pricing, BUVM called for the establishment of a dedicated regulator to govern e-commerce platforms. “We support ‘vocal for local’ and Atmanirbhar visions of the government,” said Shri Hemant Gupta, Senior General Secretary, BUVM Delhi.

“The growth of e-commerce should be balanced and must allow for fair competition and equal opportunity for small and medium Enterprises (SMEs), local traders, and traditional retailers. Like the case with Banks, insurance etc. a regulator should be appointed to oversee the functioning of e-commerce sector as well. No products should be allowed to be sold below MRP. These moves will safeguard the interest of businesses and traders.”

Redefining MSME Criteria & Compliance Burden

Shri Rakesh Yadav, General Secretary, BUVM Delhi, suggested revising the criteria for SME classification, proposing that it be based on the nature of trade, not just turnover. He also called for more reasonable Central subsidies for qualifying MSMEs.

Among its other recommendations, BUVM urged the withdrawal of TDS (Tax Deducted at Source) and TCS (Tax Collected at Source), stating that the current tax compliance load imposes excessive time and financial costs on businesses.

44th Foundation Day Celebrations & Awards

The BUVM’s 44th Foundation Day will be celebrated on August 3, 2025, in New Delhi, with dignitaries such as:

-

Smt. Rekha Gupta, Hon’ble CM of Delhi

-

Shri Arjun Ram Meghwal, Hon’ble Minister of Law & Justice (Independent Charge)

-

Shri Harsh Malhotra, Hon’ble Minister of State, Corporate Affairs & Road Transport

Business leaders and traders who have shown exceptional performance will be recognised with Bhamashah Samman, while the Lifetime Achievement Award will be posthumously conferred to those with notable contributions to BUVM’s legacy.