High Point, North Carolina: Since announcing its plan to restructure and put the company back on the path to profitability four months ago, Culp Inc. has made progress, as seen by its first quarter results.

The company’s reorganization plan is well advanced, according to president and CEO Iv Culp, who spoke with Furniture Today, a sister newspaper of HTT, about his positive assessment of the company’s performance. The company stated that it expects to have positive EBITDA in its fourth quarter when the effort was unveiled on May 1.

According to Culp, the timeframe has now advanced its projection, and the business anticipates that it will reach break-even adjusted EBITDA in the second quarter and positive adjusted operating income in the third.

Culp expressed optimism, saying, “I think we are off the bottom and turning positive.” “I think Tommy Bruno and Mary Beth Hunsberger, our new leadership, have brought in new perspectives that have improved our product. I love them. I still believe that blocking and tackling is still effective.

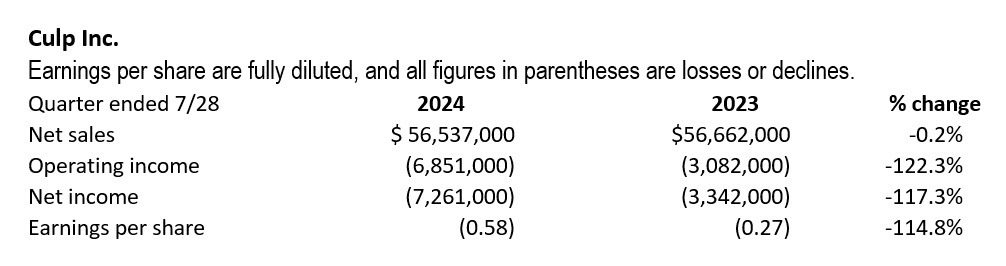

The textile company’s quarter ended July 28th results showed a $7.3 million net deficit. Compared to revenues in the fourth quarter, Culp’s net sales increased 14.2% to $56.5 million. In comparison to the same quarter previous year, the company’s net sales decreased by 0.2% to $56.5 million, but overall they remained quite stable.

Sales of mattress fabric for the first quarter of fiscal 2024 were $28.1 million, a decrease of 3.9 percent from the previous year’s sales of $29.2 million. Sales of mattresses increased by 9% when compared to the fourth quarter’s $25.8 million in sales.

In the first quarter of this year, the upholstery fabrics division’s sales increased 3.7% to $28.5 million from $27.4 million. The business reported sales of $23.8 million, a 19.7% increase over the fourth quarter’s revenues.

“The mattress fabric and upholstery businesses are both up,” Culp stated. “The market seems to have stabilized a little,” We believe that by becoming more creative and fashionable in our commercial dealings, we are strengthening our position in the market. I anticipate growth.

According to Culp, restructuring had an effect on the quarter, with the majority of the costs related to the manufacturing consolidation occurring during that time. He acknowledged that the expenses have turned out to be less than anticipated.

The way our restructuring efforts are going is another thing that gives us hope, Culp stated. “We believe we are on track to deliver our targeted improvement outcomes, including a return to near break-even adjusted EBITDA in the second quarter and a return to positive consolidated adjusted operating income in the third quarter, even though mattress fabrics operating results are being pressured by these actions in the first half of the fiscal year, especially in the first quarter. The massive project of reorganization affects personnel, plant consolidations, equipment migration,

and process upgrades, but by doing so, we are effectively reducing our cost structure in spite of the reduced demand.

Under its China credit line, the company reported $13.5 million in total cash and $4 million in outstanding debt.