Virginia’s Chesapeake During the second quarter, Dollar Tree Inc. locations saw an increase in traffic but a fall in average basket.

The primary, lower-class Family Dollar client base continues to have low demand. The major shift occurred at Dollar Tree locations, which serve a wider range of income levels, including a greater proportion of middle-class and upper-class customers.

Chief operating officer Mike Creedon told investors during this morning’s Q2 review call, “Beginning this quarter, we started to see inflation, interest rates, and other macro pressures have a more pronounced impact on the buying behavior of these customers.”

The strategic conversion of Dollar Tree stores to an in-line multi-price structure is the company’s long-term growth hope. Merely 15% of the selection in the 1,600 stores that have undergone conversion are multi-priced. There are 8,726 Dollar Tree locations.

The majority of the price-range is highly weighted toward consumables. In the second half, longer-lead, multi-priced discretionary items—including seasonal goods—will be added to the mix.

The Q2 conversion rate of stores resulted in a 4.6% increase in comp. Comp increased by 5.1% for stores that underwent a conversion in Q1, meaning they experienced sales for the entire quarter in the new format.

Creedon stated, “The most crucial thing is that the customer response is validating our strategy.”

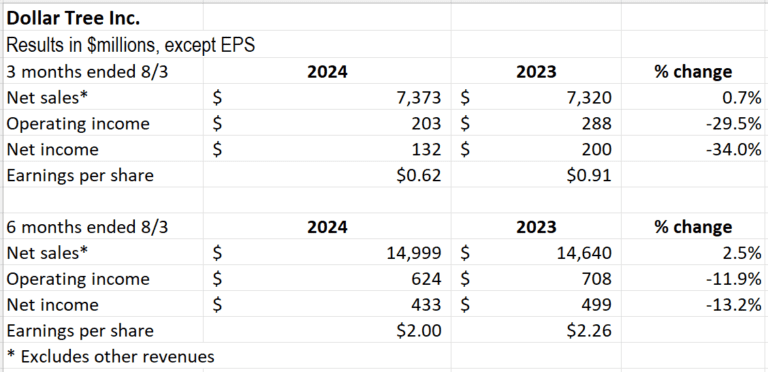

Consolidated net sales for Dollar Tree Inc. increased by 0.7% to $7.37 billion for the second quarter that ended on August 3, which was below estimates. While average ticket decreased by 0.5%, traffic climbed by 1.1%, contributing to a 0.7% increase in enterprise same-store net sales.

Despite a 0.1% drop in average ticket, Dollar Tree banner same-store net sales grew by 1.3% due to a 1.4% rise in visitors. Same-store net sales at Family Dollar fell by 0.1% as a result of an increase in traffic of 0.7% but a fall in average ticket of 0.8%.

The category with the best results was consumables. Home décor, crafts, and flowers—categories with higher profit margins—were the worst performers.

When Dollar Tree Inc. released its annual estimate today, Creedon noted that cautious spending by middle-class and upper-class consumers was the main factor in the choice.

Presently, the company projects consolidated sales for the entire year to be between $30.6 billion and $30.9 billion. It had previously projected sales of between $31 billion and $32 billion.

Additionally, Dollar Tree Inc. reduced its projected profits per share to a range of $5.20 to $5.60. According to its previous estimate, EPS would be between $6.50 and $7.00 per share.