The first Perpetual Warehousing and Industrial Parks InvIT, NDR InvIT Trust, which is listed on the National Stock Exchange, conducted its board meeting on February 10, 2025, and released its third-quarter and nine-month results, which ended on December 31, 2024.

- NAV at Rs. 127.26/unit as on 31st December, 2024

- Declared distribution of Rs. 1.75 (Rs. 0.85 as Interest and Rs. 0.90 as return of capital) per unit to the unit holders for Q3 & 9M FY25

- Assets under Management (AUM) stood at ~19.01 mn. sq. ft (msf) across India.

- Out of the 17 mn sq. ft. leasable area

- 2.01 million sq. ft. is currently under acquisition in Q3 FY25 across Bengaluru, Hyderabad, Pune, and Surat.

Mr. Sandeep Jain, Chief Financial Officer of NDR InvIT Trust, said,

“Q3 was a defining quarter for us as we grew our Revenues, EBITDA, and expanded our footprint in Prime Locations. We were also the first InvIT in India to issue ‘Sustainability Linked Bonds’ via. IFC, and NaBFID, India’s premier Infrastructure Financing Bank, also took part in our LT Bond Issuance. The proceeds of which were used to replace debt, at the SPVs thereby augmenting the cash flows at the InvIT level, and in the Portfolio Expansion. Our growth, and acquisitions strategy remain Value Accretive to our Investors.”

Business Highlights:

- Under acquisition assets of 2.01 mn sq. ft. in Surat, Hyderabad, Pune and Bengaluru

- 13 Cities, 33 Industrial Parks, 55+ Warehouses

- Pan India Occupancy Levels at ~98%

- Top 10 Clients Contribute 35% of Revenue

- ~16% of Leases coming up for renewals in FY26

Financial Highlights:

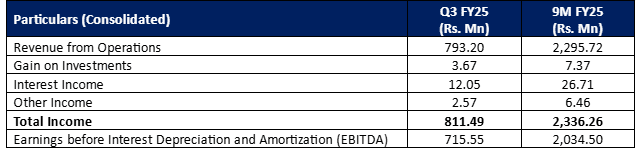

- Clocked healthy revenue growth of 5.65% and EBIDTA growth 8.86% in Q3 vs Q2 FY25

- Recorded Revenue from Operation of RS. 793.20 mn in Q3 FY25 and RS. 2,295.72 mn in 9M FY25

- EBITDA stood at RS. 715.55 mn in Q3 FY25 and RS. 2,034.50 mn 9M FY25

Distribution:

- Distribution for Q3 FY25 is Rs. 673.75 mn and for 9M FY25 is Rs. 2,407.36 mn

- Declared distribution of Rs. 1.75/unit (Rs. 0.85 as Interest and Rs. 0.90 as return of capital) per unit to the unit holders for Q3 FY25

- Record date for the distribution is February 12, 2025

About NDR InvIT Trust:

NDR InvIT Trust, the first perpetual warehousing and industrial Parks InvIT in India. The trust has an AUM of 19.01 msf (17 msf. Current AUM+ 2.01 msf. Assets in Acquisition). The asset portfolio is diversified across 60+ warehouses and 37 Industrial parks, located at 15 cities in India. At the end of December 2024, the warehouses were leased out to 90+ tenants. These tenants are spread across diversified industries including third-party logistics service providers, e-commerce, information technology and technology, engineering, automobiles and auto ancillaries, white goods manufacturers, retail and fast-moving consumer goods. At NDR InvIT Trust, we contribute to the country’s sustainable economic, and social growth by strategically managing infrastructure investments.