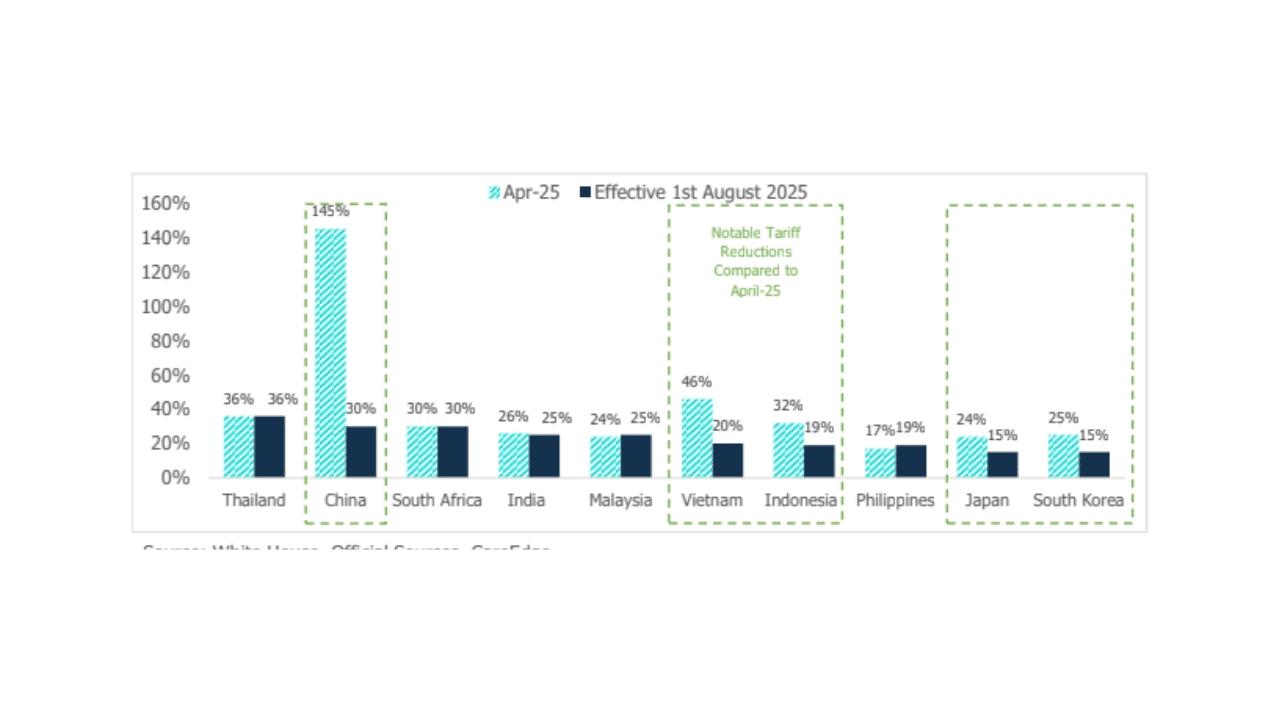

India is set to face a 25% reciprocal tariff from the US starting August 1, 2025, as trade negotiations between the two nations remain pending. While countries like Vietnam, Indonesia, and the Philippines have struck trade deals to lower tariff rates, India’s delayed agreement has resulted in it facing higher tariffs than many of its Asian counterparts. In addition, India could face further penalties due to its trade ties with Russia.

Yiğit Durak, Vice Chairman of Durak Tekstil, remarked on the potential shift in global trade competitiveness:

“At the event, we will showcase both our rich product portfolio and our vision dedicated to R&D and innovation with our technical threads for a wide range of products, from protective clothing and shoes to bags and tents. We aim to bring our value-added solutions to a wider market.”

Although India previously benefited from tariff concessions announced in April, the reversal now places its exports at a disadvantage. By comparison, Vietnam faces a 20% tariff, Indonesia 19%, and South Korea 15%.

Despite the new tariffs, the impact on India’s overall economy may be limited. As exports account for only 21% of India’s GDP (with merchandise exports forming 11%), the direct impact is projected at 0.3–0.4% of GDP. Furthermore, only 2% of India’s GDP comes from merchandise exports to the US.

India’s merchandise exports to the US amounted to USD 87 billion in FY25, led by electronic goods (17.6%), pharmaceuticals (11.8%), and gems & jewellery (11.5%). Electronics and pharma sectors have seen partial exemptions from tariffs, but discretionary exports like gems and jewellery, particularly polished diamonds, may suffer due to rising pressure from alternatives like lab-grown diamonds.

Additionally, the ongoing depreciation of the Indian rupee—down about 2% year-to-date—has made it Asia’s worst-performing currency in 2025. The pressure stems from both tariff concerns and foreign portfolio investment (FPI) outflows. The Reserve Bank of India is expected to intervene as needed but may hold rates steady unless downside risks emerge.

In the broader outlook, while India’s trade resilience is bolstered by its domestic economic structure and ongoing services exports, the uncertainty in global trade policies continues to pose a risk. India is likely to proceed cautiously in trade negotiations, particularly in sensitive sectors like agriculture and dairy, indicating a longer negotiation timeline.

Ultimately, while India’s export sectors may see some pressure from higher US tariffs, the country’s relatively lower export dependence and strong service sector should help cushion the blow. Still, indirect effects via investment sentiment, currency movements, and prolonged policy uncertainty remain areas to watch in the coming months.