Framingham, Massachusetts: TJX Cos.’s home division was doing well in the third quarter, both in foreign markets and in stores that sell a combination of clothing and home goods.

HomeGoods increased 3% in the United States, following a 9% gain in the same quarter last year. For the quarter that concluded on November 3, the chain’s net sales increased by 7% to $2.4 billion. As the company has adjusted the mix, sales at the 67-unit U.S. Home Sense chain, whose financial results are included in the HomeGoods data, have also increased.

During this morning’s quarterly call, business CEO and president Ernie Herrman informed investors that the cooperation between merchants in the Marmaxx, HomeGoods, and foreign divisions is helping the firm’s home assortments in its nameplates.

“Our clients [are] willing to search for entertaining, unique fashion home goods and a constantly evolving selection,” he continued. Over the past few quarters, that has been increasing. With every passing quarter, my optimism grows.

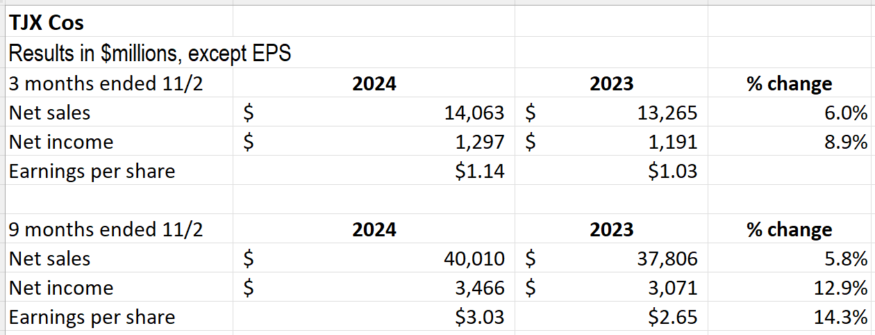

After increasing by 6% in the previous quarter, the company’s consolidated net sales for the third quarter increased by 3% to $14.1 billion. Every segment saw an increase in same-store sales, which were all fueled by more transactions.

Due mostly to a rise in the merchandise margin, the gross profit margin increased by 0.5 percentage points to 31.6% from the previous year. Diluted earnings per share were $1.14, up 11% from $1.03 in the third quarter of the previous year, while net income was $1.3 billion.

Global Development on the Agenda

TJX Cos. is taking steps to increase its global footprint. The business finished investing in the joint venture with Grupo Axo, S.A.P.I. de C.V. (Axo) in the third quarter. Grupo Axo operates international brands in Mexico and South America in both full-price and off-price formats. It has a 49% ownership position in the company, which operates more than 200 stores under the Promoda, Reduced, and Urban Store brands, thanks to its $179 million capital investment.

TJX paid $344 million to acquire a 35% non-controlling, minority equity share in Brands For Less (BFL) in the first quarter of Q4. BFL, a large off-price store of branded clothing, toys, and home goods, is based in Dubai. Currently, it runs more than 100 outlets, mostly in Saudi Arabia and the United Arab Emirates.

According to Herrman, the business may eventually run up to 100 stores in Spain after launching its TK Maxx brand there in early 2026.